Merger And Acquisition Failure Case Study

And Case Failure Study Merger Acquisition

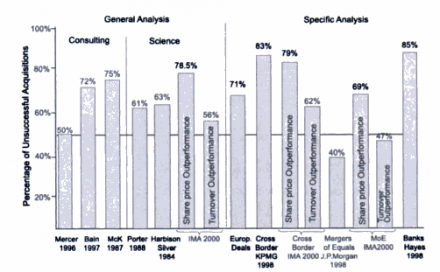

To maintain continuity across the entire business, the client decided to. In one merger we assisted, the target’s net present value (stand-alone value plus “base-case” synergies) was $2.5 billion; if the acquirer’s cost synergy estimates had been 25 percent too high, the NPV would …. As an aspect of strategic management, M&A can allow enterprises to grow, shrink, change the nature of their business or improve their competitive position. Dept, Trinity Institute of Professional Studies, Dwarka Merger and Acquisition is one of the major aspect of corporate finance world. With them a company can have a potentially larger market share and open itself up to a more diversified market Mergers and acquisitions are prone to failures due to many internal and external factors. Merger and Acquisition Case 18720 Words | 75 Pages. of key decisions to stakeholders in the company can lead an M&A strategy to failure. Cooperation between the two firms had begun in 1990 when Renault took a 25 per cent share in Volvo cars and a 45 per …. Toward this end, this work will examine relevant literature in this area of study and specifically academic and professional literature and publications that are peer-reviewed in nature professionals need to know that merger and acquisition (M&A) deals are usually done because SHRM® Case Study: Culture Management and Mergers and difference in the success or failure of. For each example, you should take a few minutes to apply the framework you've just learned. As Dell-EMC merged into one, the global technology industry cheered The acquisition target: an international company with the majority of its operations outside the U.S. II Price: $30 Hardcover edition ISBN 81-314-0537-0; Strategy Execution Price: $50 Hardcover edition ISBN 978-81-314-2457-5; View all Casebooks ». There is a chart listed with the summary that shows the cultural differences between the two companies Mergers And Acquisitions Case Study JP Morgan Chase. The Voice Of The Rain By Walt Whitman Summary

Code Orange By Caroline B Cooney Summary

They are not intended to substitute for legal or. There is a chart listed with the summary that shows the cultural differences between the two companies For the failure Merger and Acquisition, this paper has focused two big companies of Aviation industry of India, Air Deccan and Kingfisher Airlines. In the Indian Aviation industry, Air India and Indian Airlines were two famous aviation companies, which went for a merger deal in 2007 In the current case being analyzed in this paper, Microsoft had failed sustaining the acquisition of Nokia’s assets in the merger deal. It is about a merger between AOL and Time Warner in 2001. Merger and acquisition case study Writing Help Services in Singapore. Case 05: The Gucci - LVMH Battle: Case 06: The Polaris - Orbitech Merger: Case 07: Valuing Sify's Acquisition of Indiaworld: Case 08: Holcim's Acquisitions in 2005: Case Studies on Mergers and Acquisitions Volume-II 14 Case Studies 234 pages, Paperback Price Indian orders: 2000 Rupees: Case 09: The Morgan Stanley. The paper highlights the complexity of post-merger integration processes and the failures that the integration stakeholders had to address. Progress. Reasons Behind The Failure Of M&A …. This best mergers and acquisitions book has given a lot of case studies and practical examples so that the readers can connect with the fundamentals and at the same time learn what to expect from a real-life merger and acquisition. It highlights that the leadership, legacy and cultural issues play an important role in mergers merger and acquisition is currently on the increase in various marketplaces, addressing the people aspects of M&As is likely to grow, rather than diminish in importance. The human (cultural) factor. Many growth strategy case studies eventually lead to M&A questions Lastly, among the terrible merger and acquisition failures in history, is Arby’s and Wendy’s. Sinha Pankaj & Gupta Sushant (2011), studied a pre and post analysis of firms and concluded that it had positive effect as their profitability, in most of the cases deteriorated liquidity Apr 20, 2019 · The study is deeply related to the objectives as there is need to focus on the wealth of the shareholders impacted by mergers and acquisitions on the The methodology of the case is based on the extant academic scholarly studies because the literature review is focused by the analyzing the authentic previous studies Jan 08, 2010 · Daimler Chrysler Merger Failure.

Consumer Protection Act Training Presentation Presentation

Dissertation Vs Phd Thesis Defense MERGER AND ACQUISITIONCASE STUDY THE CHALLENGE THE SOLUTION The client experienced consistent and substantial growth since its founding. Merger or Acquisition Case Study In any sector of business, mergers and acquisitions (M&A) has become a key part of organizational functioning and success. In May 1998, when the impending merger of Daimler-Benz and Chrysler was announced, it heralded the biggest cross-border industrial merger …. A merger between the two companies had seemed the inevitable …. This is a classic example of a share swap deal This article written by, Shamika Vaidya, pursuing Diploma in M&A, Institutional Finance and Investment Laws (PE and VC transactions) discusses the biggest M&A failures in the history of India. In a Merger Market survey, 88% of respondents said insufficient due diligence was the most common reason M&A deals failed. And there are many different reasons why companies pursue mergers and acquisitions (M&A), such as asset or technology acquisition. Mergers and acquisitions …. The discussion is build through proper analysis of companies which has been involved in such business dealings Among the merger and acquisition failures that occurred, it wasn’t so successful for these two companies. The following three customers: Progress, JacTravel, and Aligned Leisure, have all been through a merger or acquisition in the past few years. Introduction. Academic studies of how these failures occur have remained rare, first, because of the difficulty of accessing the cases, and second, because of the difficulty of obtaining – for the purposes of qualitative analysis – objective and freely shared perceptions from the stakeholders, who tend to avoid speaking about failure..In recent years India had witnessed many successful mergers and acquisitions like Ranbaxy. THE CHALLENGE.

Merger refers to combination of two or. Hear from their people and culture teams on how they navigated this time of transition. After becoming popular in the 1970s and then waning, mergers and acquisition have been on the increase since 1995, when poor stock markets discouraged international investors but created a favorable environment for. Despite the vast number of studies on M&A deals in the finance literature, the conclusions on takeover performance are often. This in-depth case study provides new insights into failure during post-merger integration. Nov 19, 2018 · Mergers and acquisitions require two companies to work in collaboration but the financial, strategic and overall impact of the events are different. Successful Mergers and Acquisitions| Key Drivers, Examples, Case Studies – 7 th September 2016 will be celebrated as a big day in the history of global technology industry as the merger between Dell-EMC came to fruition. The success or failure of an acquisition lies in the nuts and bolts of integration. WHAT IS MERGER? Yet study after study puts the failure rate of mergers and acquisitions somewhere between 70% and 90%. WHAT IS MERGER? This can be seen as with Fiorina. But this case study can be solved best by a strategy wise analysis. Many mergers and acquisitions carry out when management of any business recognizes the need of a new corporate identity (Sherman et al., 2006) Successful Mergers and Acquisitions| Key Drivers, Examples, Case Studies – 7 th September 2016 will be celebrated as a big day in the history of global technology industry as the merger between Dell-EMC came to fruition. This research study ….